In late December, President Trump signed legislation that retroactively renewed the $1-per-gallon biodiesel tax credit and extended it through 2022. It marked an enormous victory for not only the travel center industry, but also for the environment and America's truck drivers and consumers.

Importantly, it allows diesel retailers to receive significant profits from blending bio into their diesel.

Let’s take a look at what this means from an individual truckstop or travel center operator’s perspective.

First, let’s cover what the biodiesel tax credit is.

The biodiesel tax credit allows qualified biodiesel producers or blenders an income tax credit of $1.00 per gallon of pure biodiesel or renewable diesel produced or used in the blending process. The biodiesel tax credit was not only reinstated for 2018 and 2019, but also put in place for 2020, 2021 and 2022. If you become a qualified blender, you may also open doors to RIN credits (more on that later).

You can approach this in two ways:

- Invest in the infrastructure necessary to blend yourself and subsequently become the qualified blender; or

- Understand the opportunity and then take that knowledge and negotiate with your diesel supplier.

Let’s try to answer some questions to help you understand your options.

What is a “Qualified” blender?

Qualified blender is a company that is registered with the U.S. Internal Revenue Service (IRS) as a blender. You will need to apply for a 637M Blender’s License.

NATSO members frequently ask if it is worth registering with the IRS. As I tell them, it depends on several factors, such as:

- Is biofuel available in your area?

- What is your cost to blend?

- What is the additional margin contribution available to you?

- How can you manage this opportunity?

- If you register to be a blender under the IRS to gain the BTC, should you also register under the EPA’s Renewable Fuel Standard to gain the RIN credit?

Let’s go through and try to answer your questions, starting with step one.

Q: Is biofuel available in my area?

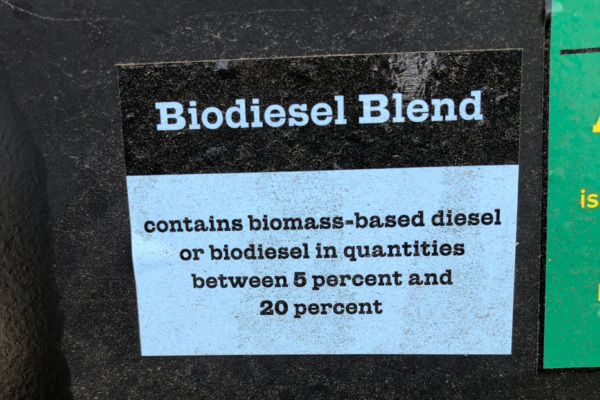

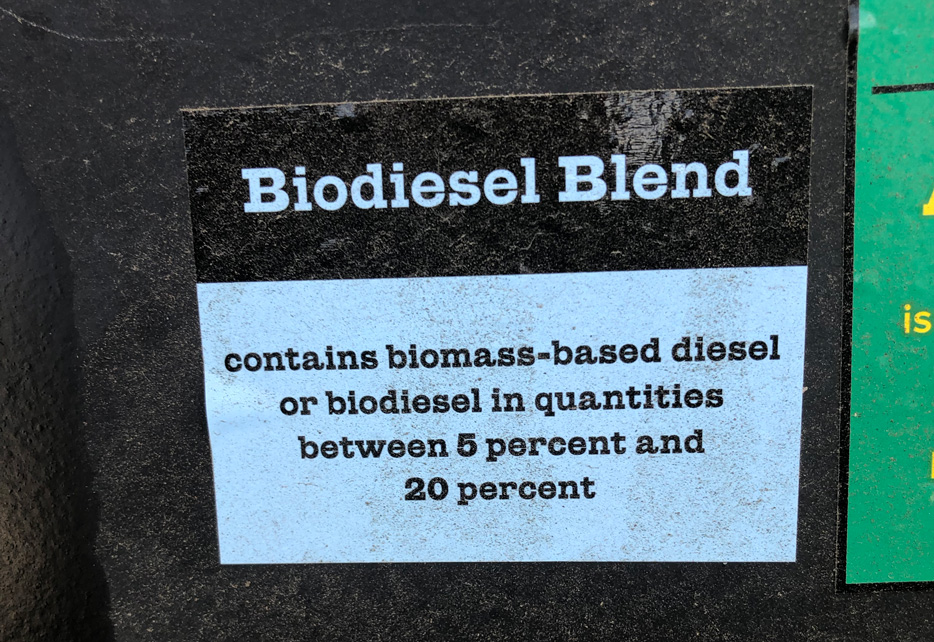

A: One way to determine if biofuel is available in your area is to visit a few of your competitors and look for this sticker on their diesel dispenser.

Anyone who sells bio blends over 5 percent is required by law to post this decal on their dispensers.

Another way would be to simply ask your supplier if bio is available in your area. I would encourage you to call several suppliers in your area to see if any of them is selling fuel blended with bio. Another way to determine if bio is available in your area is to visit the website of one of your nearby competitors as some post the bio blend on their website.

I would also suggest looking to see what is available through the terminal you are pulling ULSD from as this would make for easier blending logistics. This typically means purchasing through a wholesaler. If you want to go directly to the biodiesel producer, contact Ginger Laidlaw at NATSO’s Alternative Fuels Council at glaidlaw@NATSOAltFuels.com.

Q: So how much are we really talking about here in cents per gallon?

A: There is simple math to determine the Blenders Tax Credit margin contribution: B-5 is worth 5 cents per gallon, B-10 is worth 10 cents per gallon and B-20 is worth 20 cents per gallon.

Please note that some states offer additional incentives for bio blends. These include Texas, Illinois, Iowa, California, Washington and Oregon. If you need additional information regarding state specific incentives, please contact us.

It is also important to note that biodiesel is priced higher than ultra-low-sulfur diesel (ULSD), and a number of factors go into determining the ultimate blending economics. NATSO’s Altnerative Fuels Council has a calculator to help operators determine the pricing benefits at https://www.natsoaltfuels.com/calculator.html.

In addition to the IRS Blenders Tax Credit, the blender-of-record can also receive RIN credits on gallons of B100 or B99. To qualify for RIN credits, an operator must be registered under the U.S. EPA’s Renewable Fuel Standard (RFS). The Alternative Fuels Council staff have assisted almost 200 companies with RFS registrations and reporting requirements. NATSO has made this easy for you to manage! As an example of the benefits, the BTC adds $1/gallon benefit while the variable RIN credit adds another $0.75/gallon benefit. The RIN value can change daily and has been as high as $3.00/gallon.

For a better understanding, please visit https://www.natsoaltfuels.com/index.html. I also suggest setting up a one-on-one meeting with our Alternative Fuels Council staff whenever you are ready to dive into the blending discussion.

Q: What are RINs?

A: Simple answer, RINs or Renewable Identification Numbers are created when qualified renewable fuel producers create the wet gallon. The RIN is to be sent downstream, with the gallon, to the blender. Once the gallon has been blended with standard fuels, the blender can remove and sell the RIN credit.

NATSO’s Alternative Fuels Council has created an online application that manages all aspects of RIN credit reporting. It is staffed by experts in renewable fuel management.

The EPA has mandated that “Obligated Parties” (most refiners/importers) meet certain renewable fuel volume obligations based on their production. Since most refiners do not make or buy renewable fuels, they must purchase RINs from those that do blend renewable fuels, such as biodiesel, ethanol and renewable CNG. Initially this sounds a bit overwhelming, but the Alternative Fuels Council can explain it in greater detail, simplifying the process.

You do not have to register as the “Qualified” blender! It is important to understand the economics to be able to negotiate a lower cost! It is my opinion, however, that controlling all of the variables (BTC, RIN, etc.) puts you in the driver’s seat and optimizes your fuel margins. However, I also understand this is not for everyone.

Strategies to Take Advantage of This Opportunity

You now have a better understanding of what the BTC and RIN’s are, so let’s discuss some strategies to help you take advantage of this opportunity.

Once you find supply, ask suppliers how they are passing through the $1.00 Blenders Tax Credit.

It is possible that they are not getting the entire $1.00 BTC as some bio producer’s sell what is called B-99, which allows them to claim the $1.00 BTC. Subsequently, they may or may not pass down some of this value.

You should also ask if they are separating or stripping the RIN’s, which they probably are. If you are buying directly from the renewable fuel producer, you are more likely to have access to the RIN credits and the BTC. By having these discussions with your supplier, you are telling them you understand that credits are available and that they will likely need to pass this along to you. I suggest getting bids that show pricing with and without the RIN and BTC.

The second opportunity is to become the Qualified Blender and negotiate with the bio producers for the BTC and RIN’s directly. The good news is that with a three-year extension of the biodiesel tax credit, it is possible to justify the investment and position your business to take advantage now and in the future.

Need Help?

Should you be interested, please contact us to help you understand this opportunity as each location has different attributes to consider.

NATSO’s Alternative Fuels Council and Travel Center Profit Driver Program can assist you in not only bio and ethanol opportunities but also a multitude of other opportunities. Please contact us to discuss how we can help you take advantage of these member services! (You can also watch a video here to learn more about the services NATSO’s Alternative Fuels Council provides.)

Contact me at (703) 739-8572 or dquinn@natso.com.

Contact Ginger Laidlaw, Alternative Fuels Council vice president, at (515) 988-1626 or glaidlaw@natsoaltfuels.com to request a demo. Visit Alternative Fuels Council's website for more inforamtion.

Subscribe to Updates

NATSO provides a breadth of information created to strengthen travel plazas’ ability to meet the needs of the travelling public in an age of disruption. This includes knowledge filled blog posts, articles and publications. If you would like to receive a digest of blog post and articles directly in your inbox, please provide your name, email and the frequency of the updates you want to receive the email digest.