Biodiesel can be blended and used in many different concentrations, and adding biodiesel to a location’s offerings does not require truckstop and travel plaza operators to buy new equipment.

Myself and my colleagues at NATSO's Alternative Fuels Council presented a webinar digging into biodiesel blending practices.

Watch our eighteen-minute presentation below.

Here are a few important notes from the presentation:

The cost of blending biodiesel varies based on the type of blending locations use. Jeff Hove of NATSO’s Alternative Fuels Council, described the various methods while presenting during a NATSO Alternative Fuels Council webinar.

“As folks are looking at biodiesel, one of the big questions is what is the cost of new infrastructure we have to extend in order to take on the new fuel,” said Hove. “It can be very little or up to $70,000 for a new in-line blending system.”

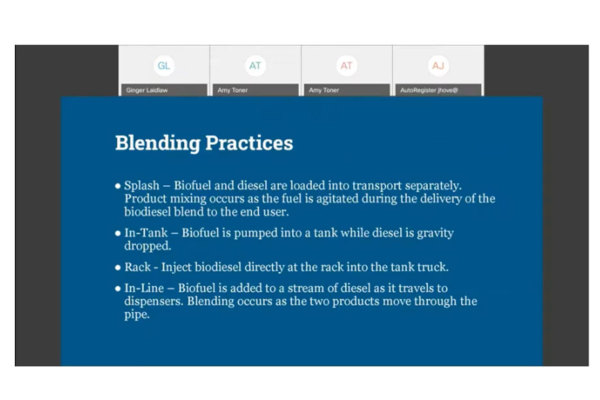

The splash method of blending doesn’t require any specialized equipment. Biofuel and diesel are loaded into a transport separately, and product mixing occurs as the fuel is agitated during the biodiesel blend's delivery to the end-user.

With in-tank blending, biofuel is pumped into a tank while diesel is gravity dropped.

In-line blending, however, does require the addition of new equipment. With in-line blending, biofuel is added to a diesel stream, and blending occurs as the two products move through the pipe. Hove said the benefit of an in-line blending system is that it allows operators to control their blend percentages from the office. “You can literally adjust your flows from inside your office back at headquarters,” he said.

Hove reminded attendees that NATSO's Alternative Fuels Council created a Biodiesel Fuel Quality plan to help operators understand how to best handle the fuel. "We worked with a lab to get some critical spec analysis done, so you're not running a full ASTM sweep," Hove said. "We focused on what analysis operators should be looking at for biodiesel and got lab costs down to $150 if you want to send in a sample."

During the session, Hove also discussed the benefits operators could obtain through the IRS blenders tax credit (BTC). The credit had lapsed in 2018 and 2019, but Congress re-established the $1.00 per gallon credit for B100 through 2022 and retroactively for 2018 and 2019. “That means there is a lot more assurance given to the industry that this credit is going to be around through 2022,” Hove said.

Operators who want to be the blender on record have to have two licenses, the 637S license for inside terminal blending/position holder and the 637M license for downstream of terminal blending. "Getting the 637S license is much more intensive. The Alternative Fuels Council can help you obtain these,” Hove said.

As it stands now, the BTC is currently considered non-taxable income, but a blender must account for any fuel excise tax liability. “If you’re buying B100 and blending B20, you owe the 24.4 cents on the federal tax on that,” Hove said. “You would lessen your dollar per gallon by that, and that is your non-taxable income.”

Subscribe to Updates

NATSO provides a breadth of information created to strengthen travel plazas’ ability to meet the needs of the travelling public in an age of disruption. This includes knowledge filled blog posts, articles and publications. If you would like to receive a digest of blog post and articles directly in your inbox, please provide your name, email and the frequency of the updates you want to receive the email digest.